Scammer House of Horror

The Cifas Scammer House of Horrors campaign educates and explains some of largest frauds and scams targeting the public. The following comics explain these threats in a light and easy to understand way.

Make sure to check out the links and additional information included below the comics.

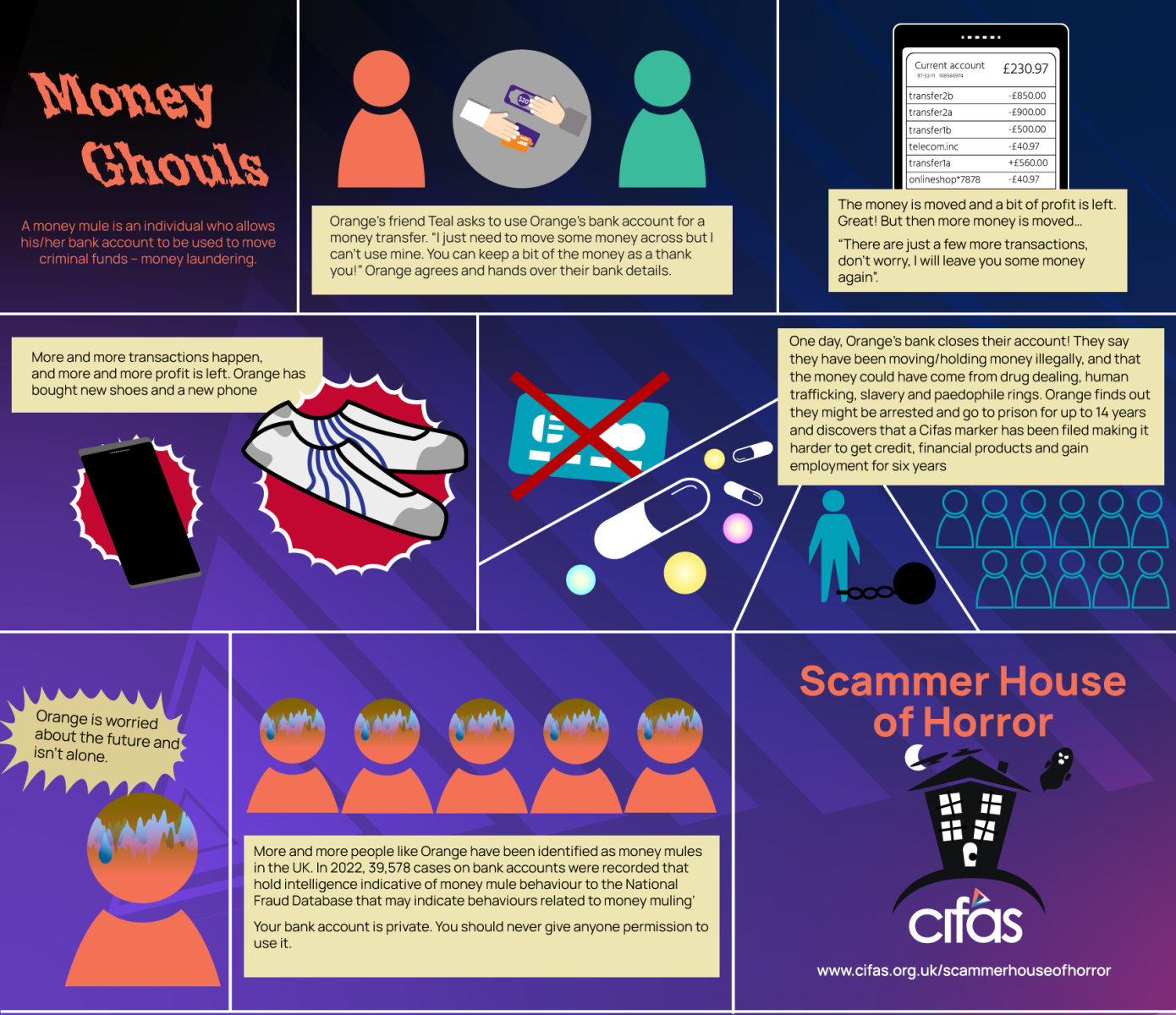

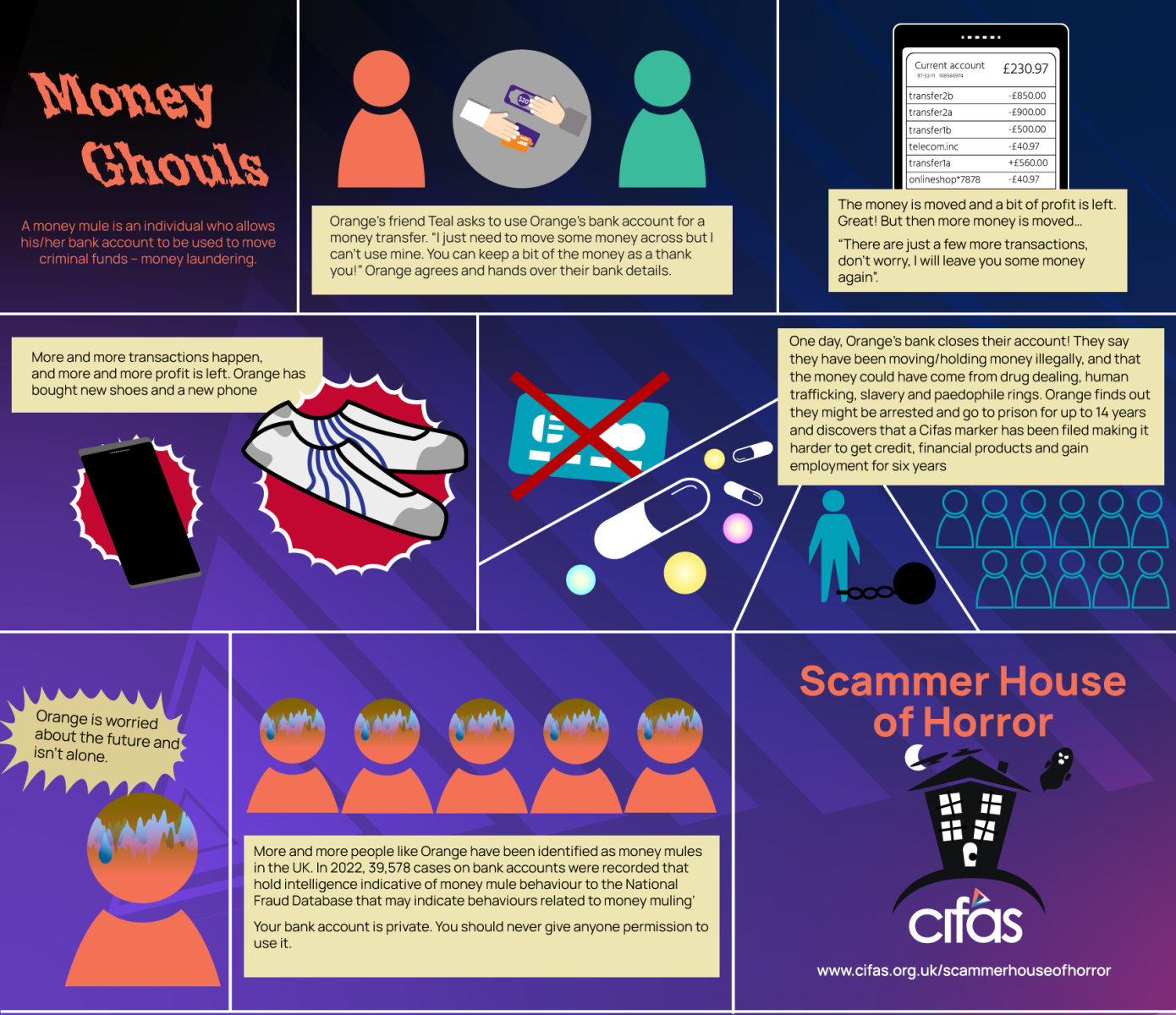

A money mule is an individual who allows their bank account to be used to transfer money to be used in the proceeds of crime, and it is a criminal offence which can result in up to 14 years in prison.

Money mules are paid by criminals to hide cash made from illegal activity, and many don’t realise they’re involved in criminality.

Data exclusively revealed on BBC’s Crimewatch Live shows 78% year-on-year increase in under 21s taking part in money mule activity | Cifas

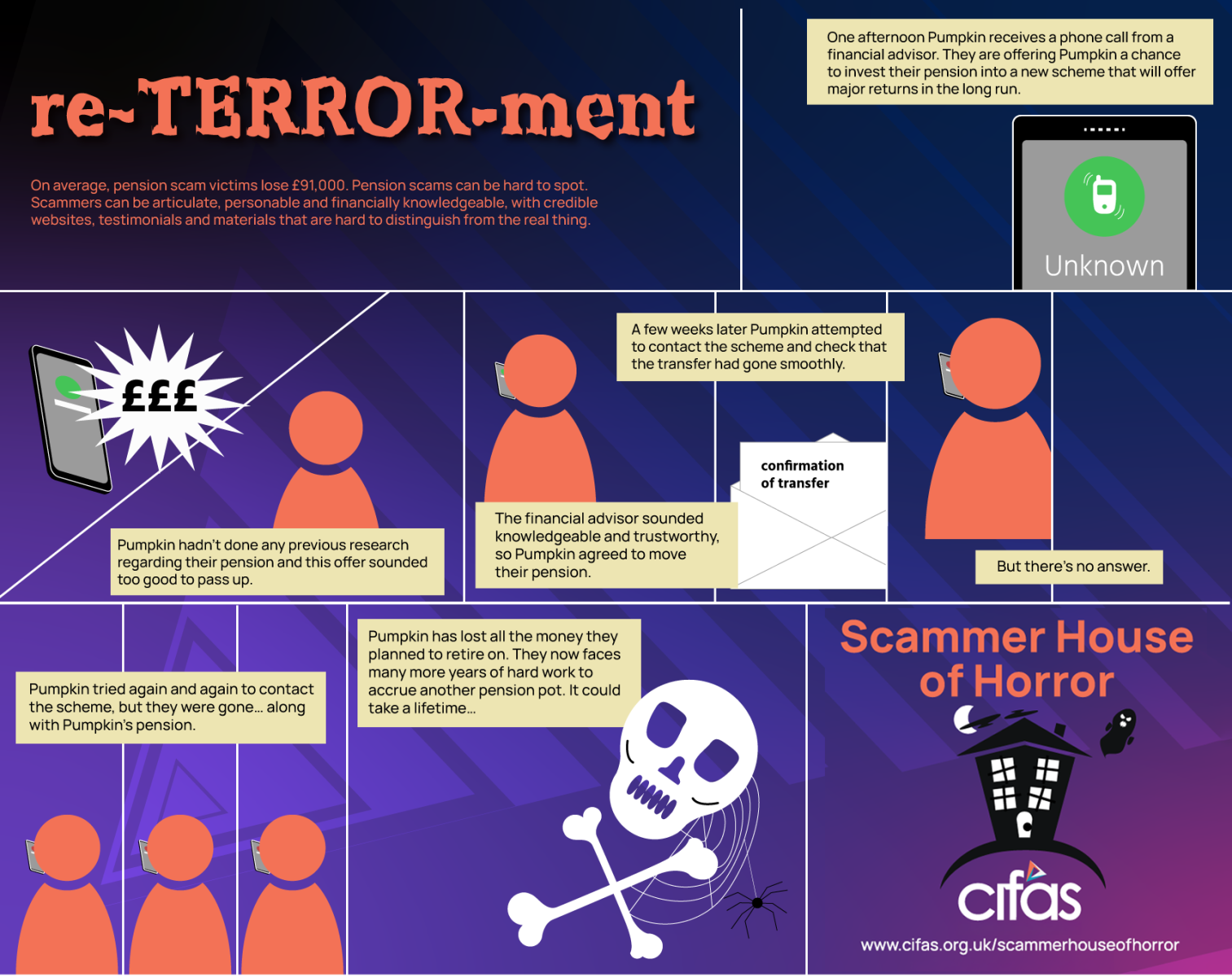

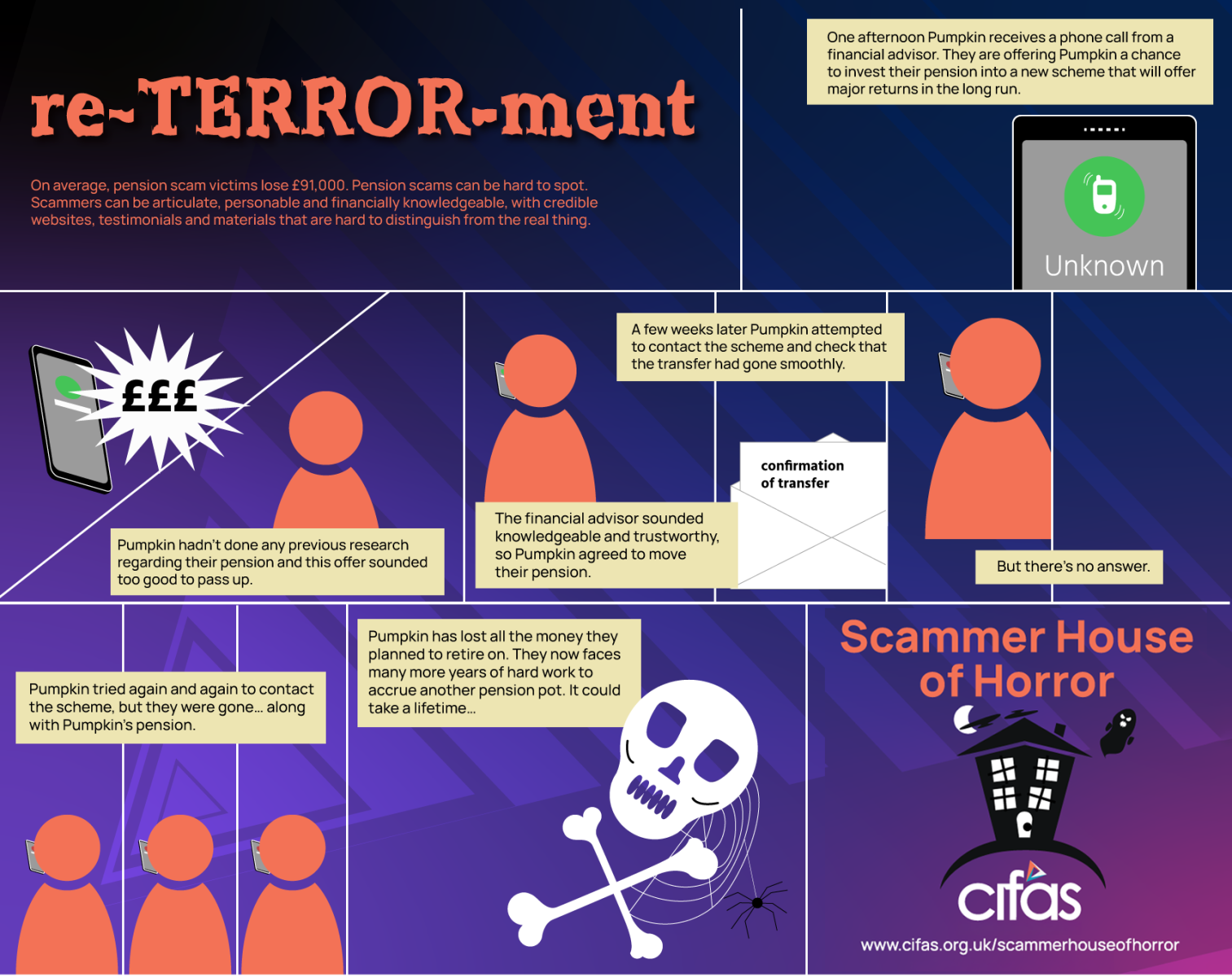

Unscrupulous scammers are currently targeting the pensions of those people in or nearing retirement. Research from the Pensions Regulator (TPR) and Financial Conduct Authority (FCA) has already uncovered some concerning statistics around pension scams, and Action Fraud, the UK’s fraud reporting centre, has recorded total losses of nearly £970,000 owing to Covid-19 fraud in February and March, with a marked increase in online fraud specifically.

Cifas weekly coronavirus scam update - holidaymakers & pensioners targeted by fraudsters | Cifas

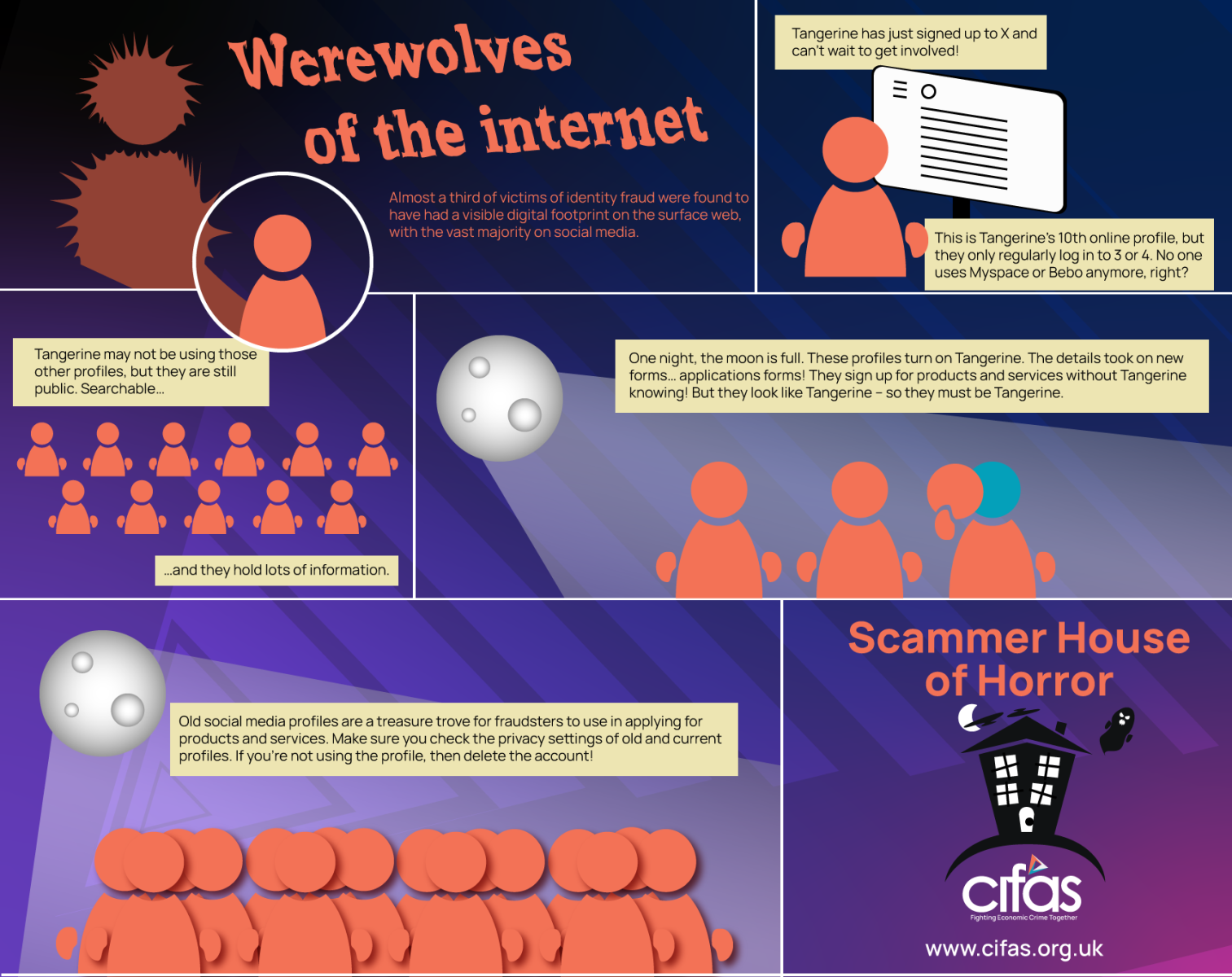

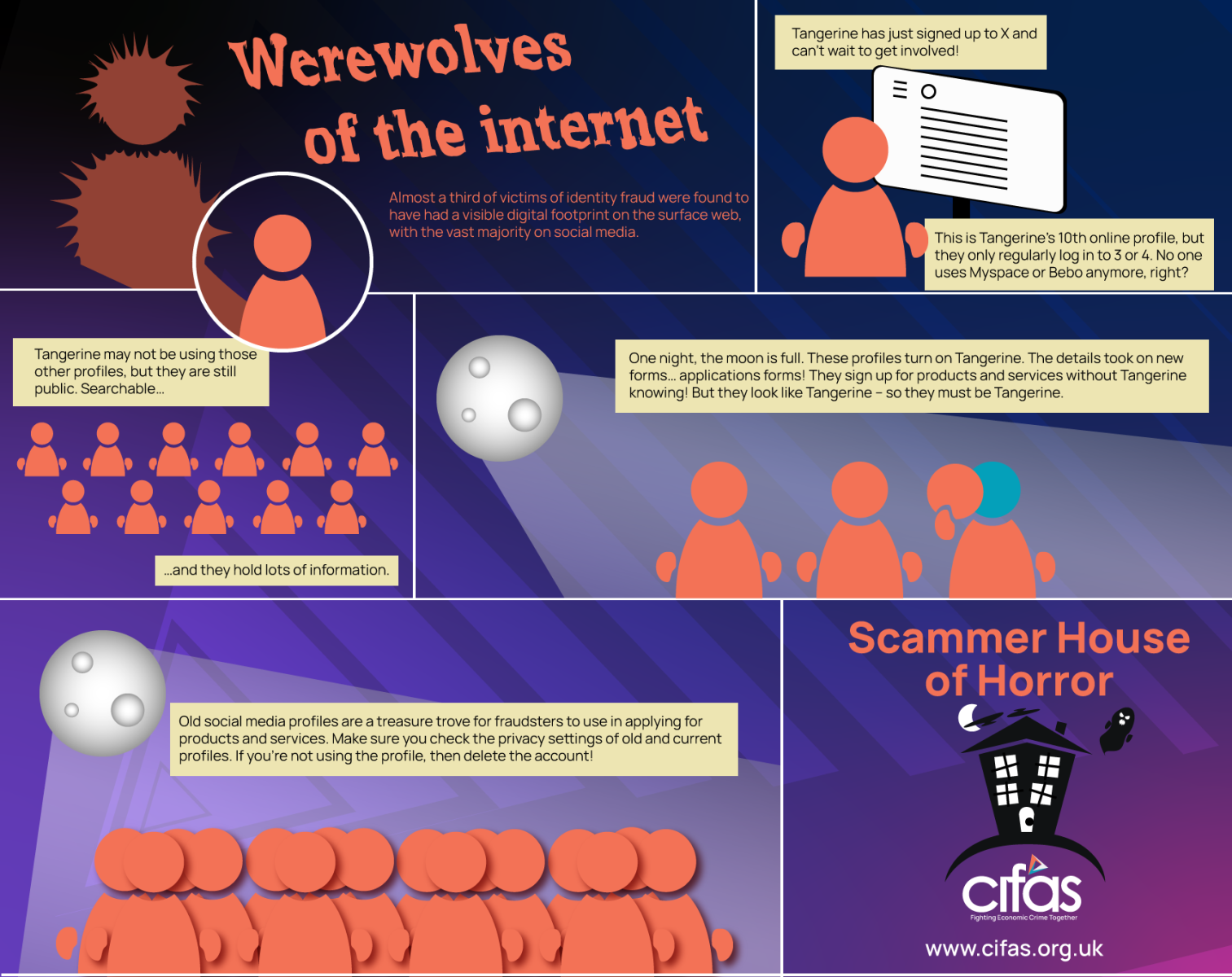

In 2018 we released our report Wolves of the Internet: Where do fraudsters hunt for data online?, which looked at what personal information is available on the Internet and how it can all be pieced together. The report showed that 65% of identity fraud victims have a visible social media presence or have been victims of a data breach.

Digital footprints online – what we leave behind | Cifas

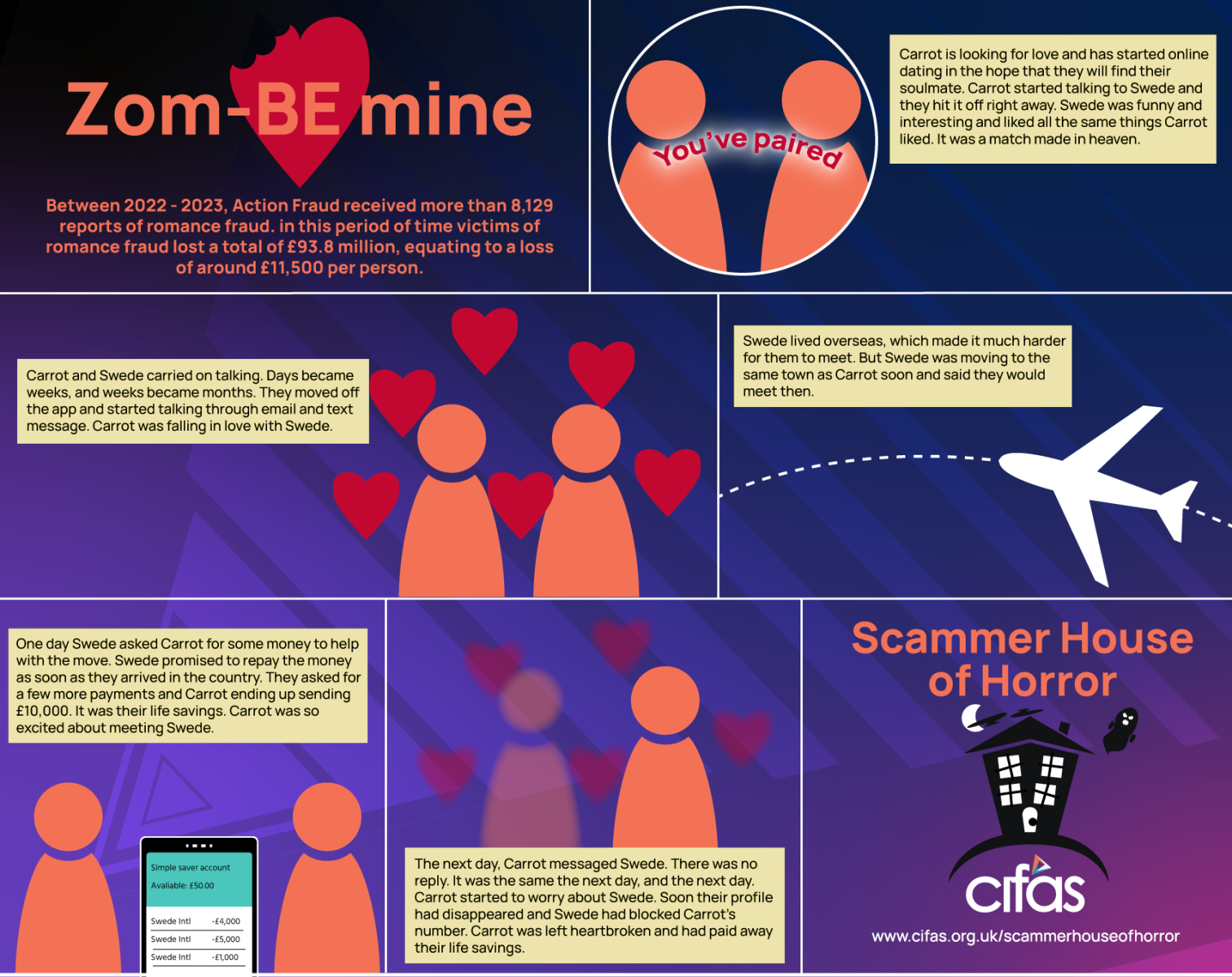

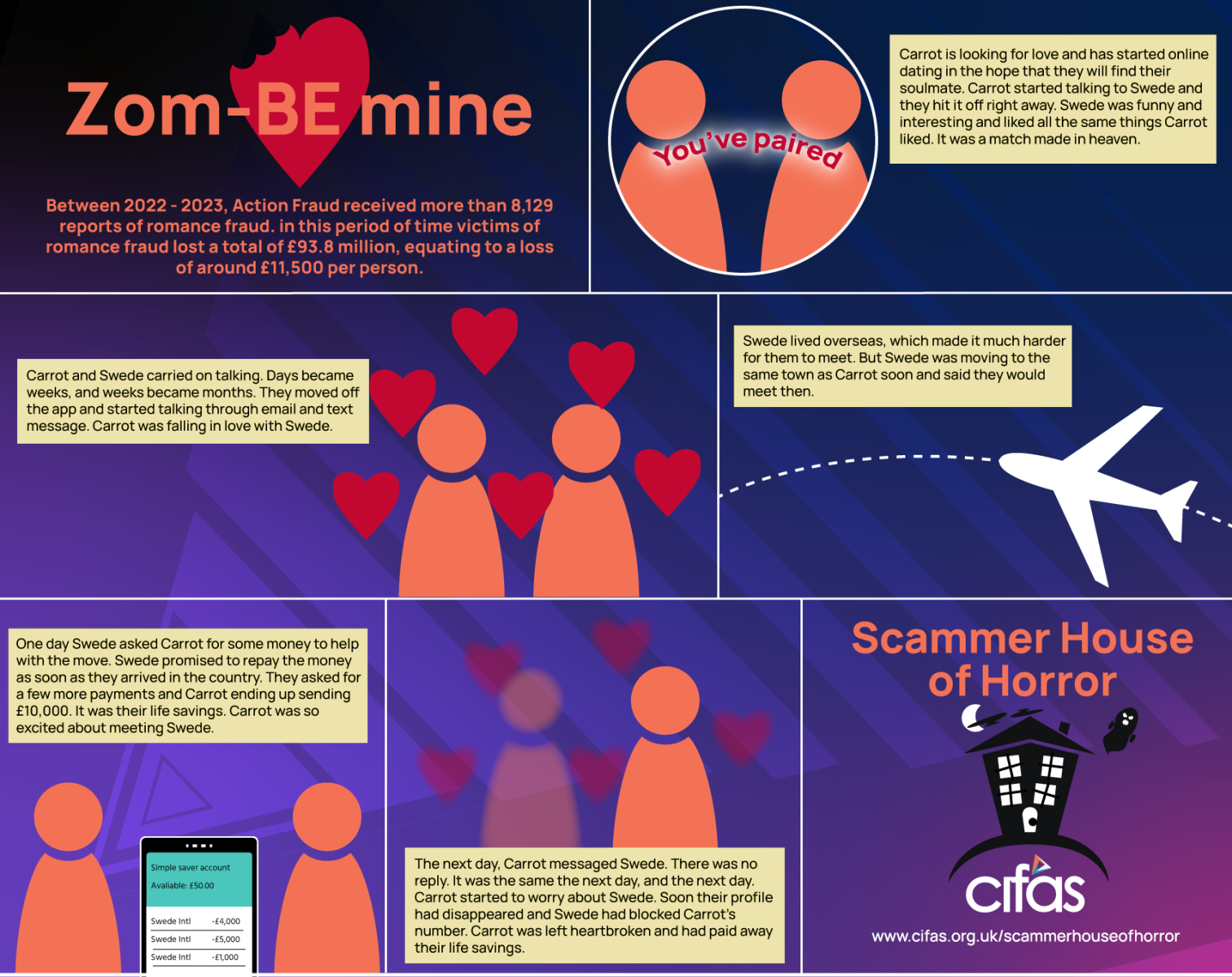

Fraudsters comb through online dating sites to see who bites, and unfortunately it is usually someone over the age of 45 or a more vulnerable person. Many of these victims are sought out directly by the fraudsters, as they may be more trusting or hopeful after a previous relationship – and may have more money to be convinced of parting with. These victims are socially engineered to trust the person on the other end of the phone, which in some cases happens over a course of weeks, months or even years.

Romance Fraud: know who you’re talking to | Cifas

Romance Fraud: don’t take the bait | Cifas

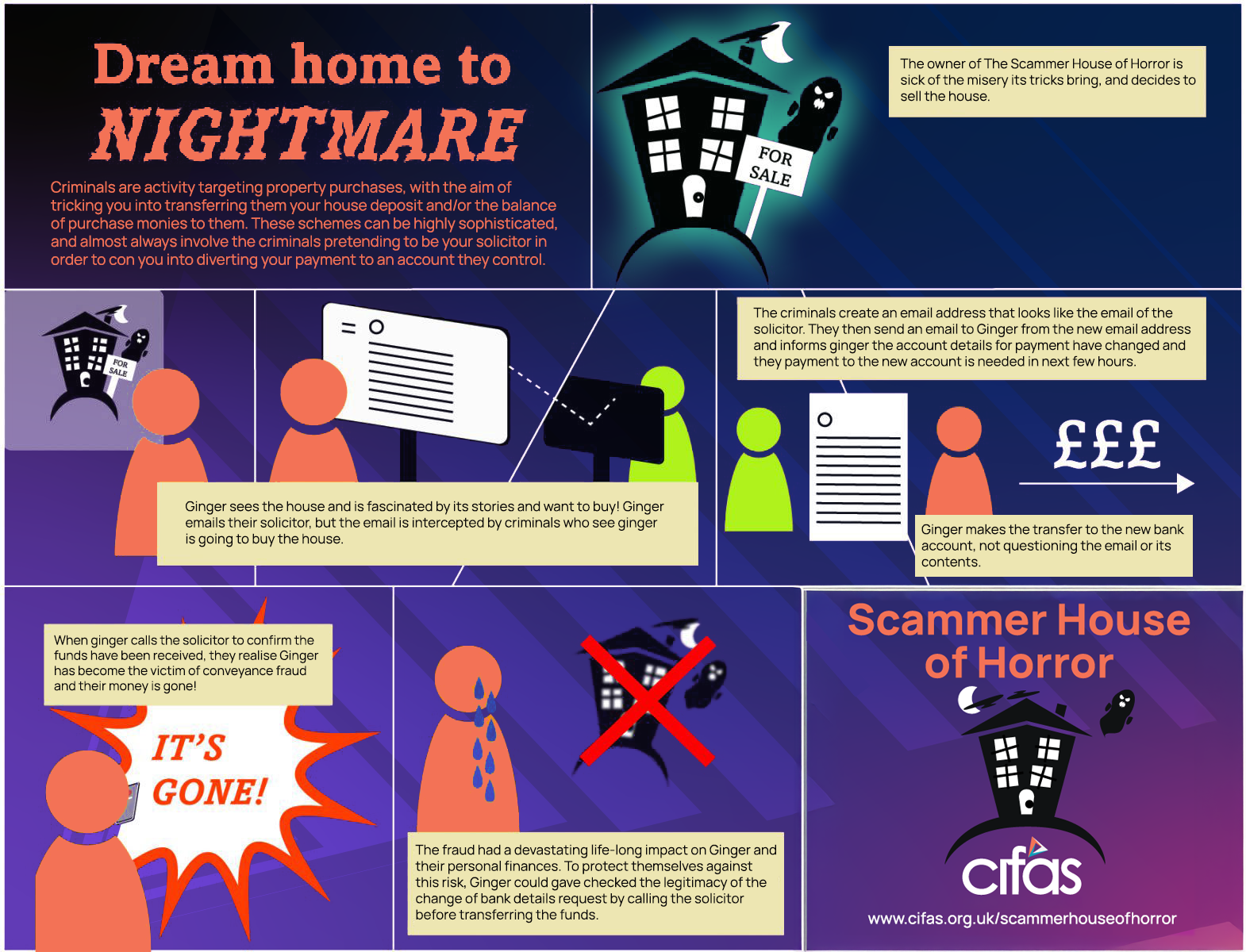

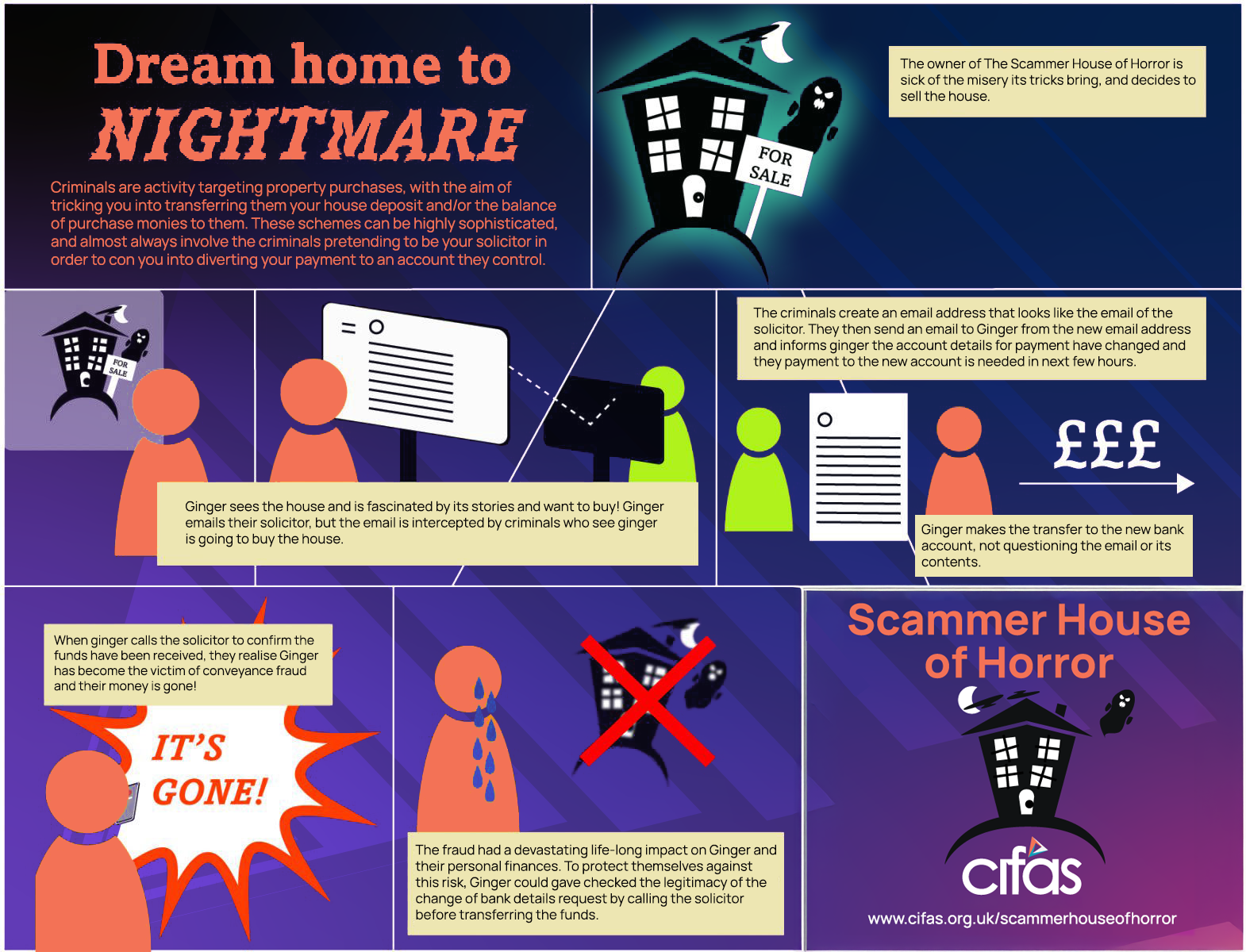

Don’t let buying your dream home turn into a nightmare! Criminals actively target property purchases with the aim of tricking house buyers into transferring funds to them. Discover more about conveyancing fraud and Payment Diversion Fraud at: https://www.actionfraud.police.uk/a-z-of-fraud/payment-diversion-fraud

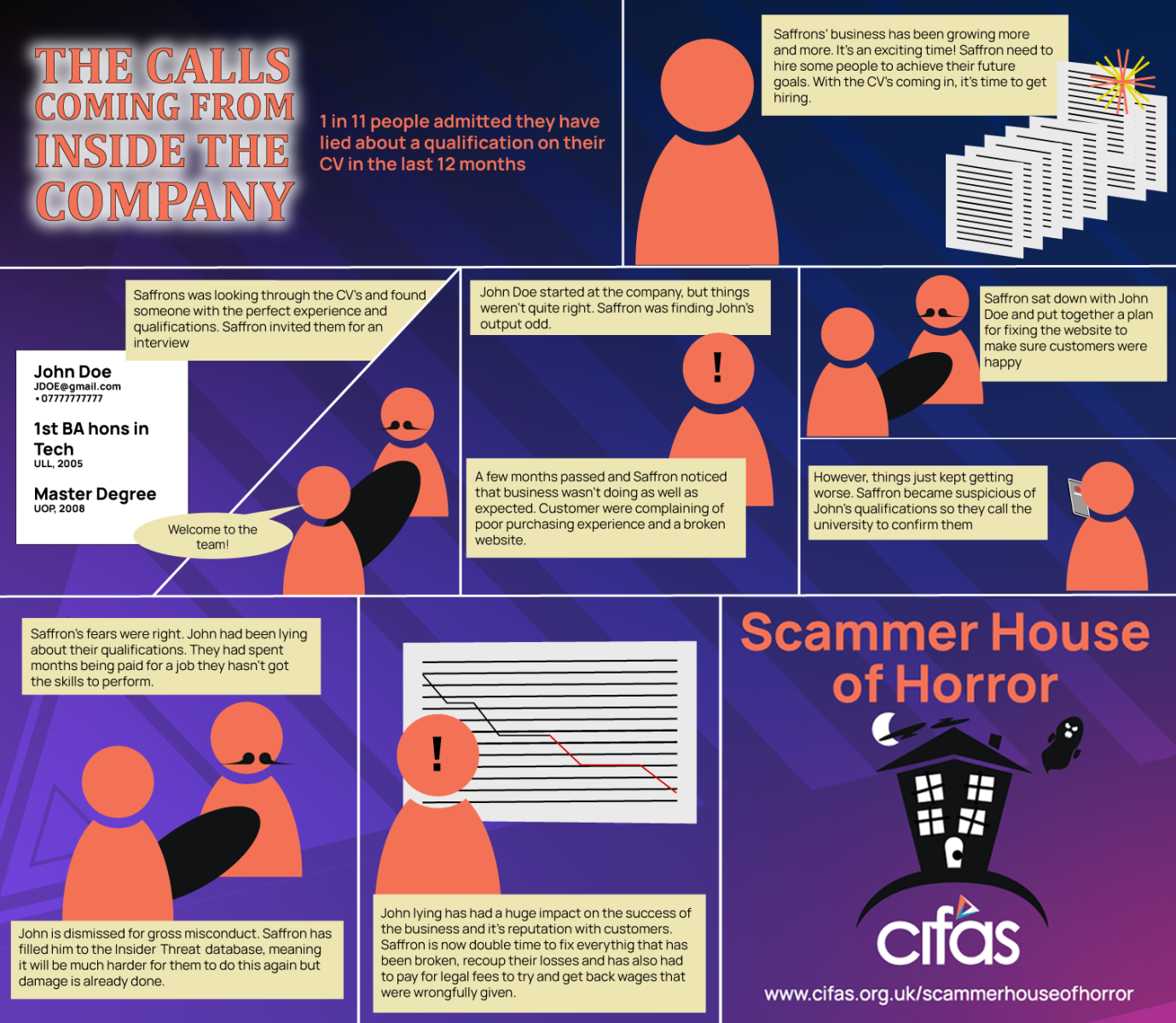

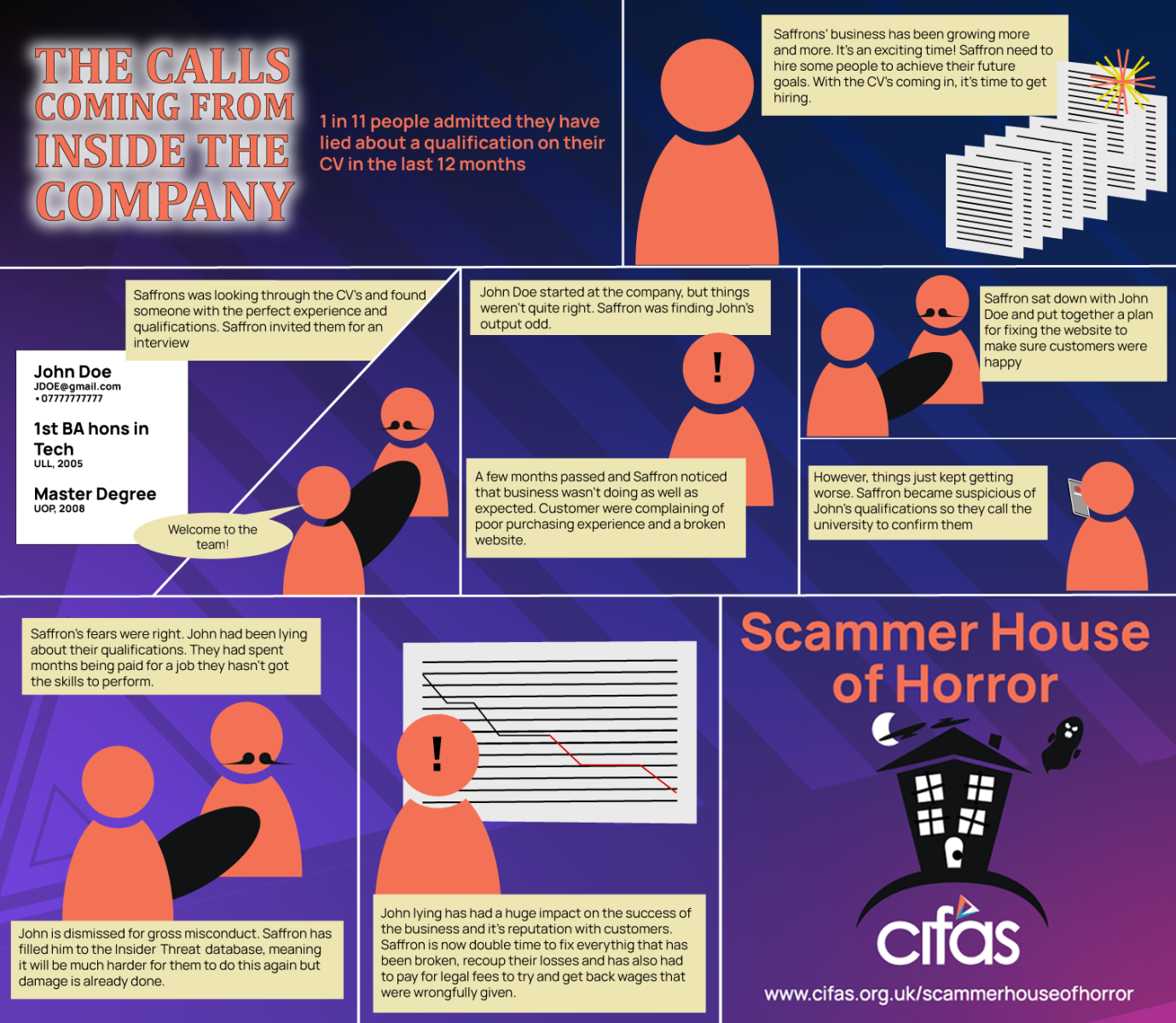

When Saffron hires a new employee she’s shocked when profits start to plummet. Is there something wrong with the business or is the problem coming from inside the company? And just who is the mysterious John Doe…