Cifas Annual Report

Cifas Annual Report

For the first year we are presenting our report entirely online. We hope you like the new format and would love your feedback.

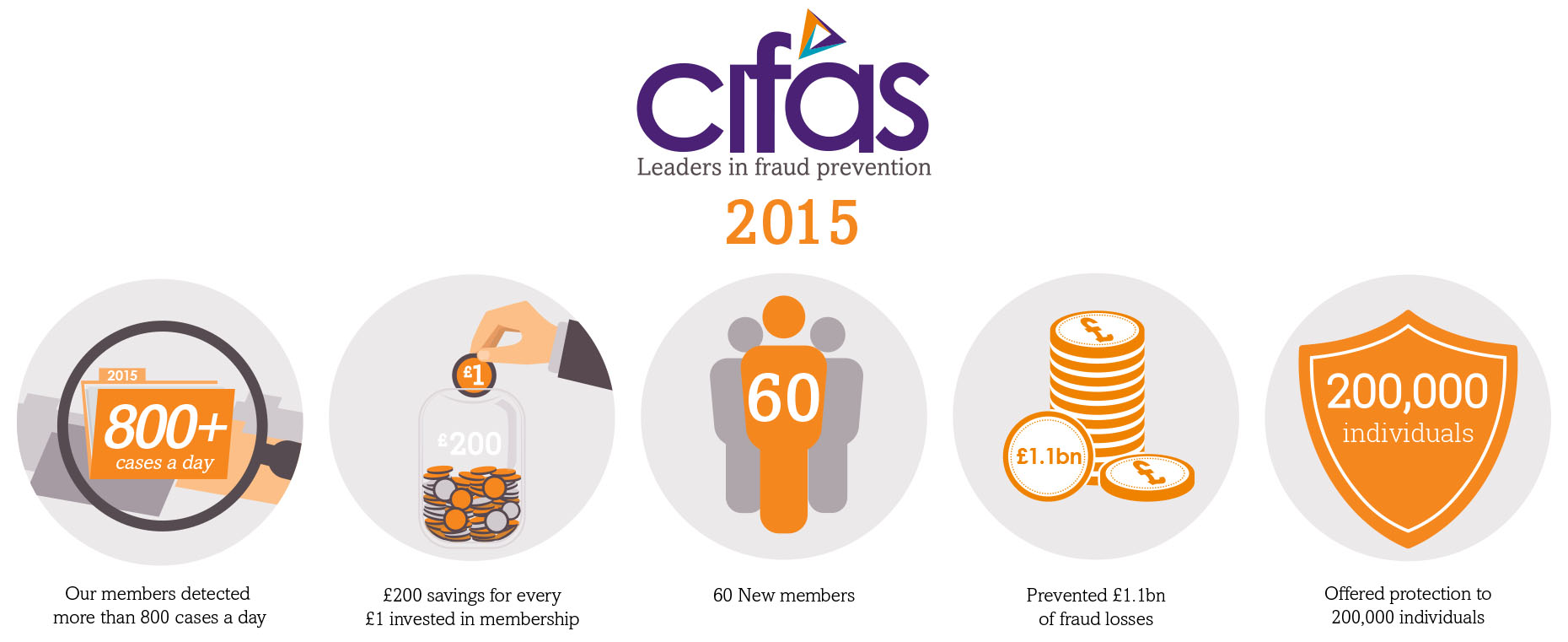

2015 was a busy year for Cifas. We continued to grow, welcomed 60 new members, updated and relaunched our main database and recorded 320,900 confirmed fraud cases. At Cifas our mission is to deter, detect and prevent fraud and related financial crime. In 2015, our members prevented £1.1 billion of fraud losses and offered protection to approximately 200,000 individuals.

We know that the risks from fraud and other financial crime continue to evolve and as the threat changes we are always looking to modify our response. But preventing one billion pounds from falling into the hands of fraudsters for two consecutive years is a huge achievement – and it shows us that working collaboratively, working across sectors, and sharing intelligence and data really are some of the most important ways to fight fraud and financial crime.

Title: Introduction and Overview

Featuring: Simon Dukes, Chief Executive, Cifas

In 2015, we enabled over 350 organisations from a range of sectors, and with different IT systems and capabilities, to securely share data for the prevention of fraud and protection of citizens. In 2015, we saw our data being used in new and innovative ways by our members, with a number moving beyond using fraud data at application stage and using it across the customer lifecycle. This enabled them to prevent more fraud and protect more individuals.

We also saw our data used in new sectors – such as the charity and tenant vetting sectors – for the first time, in addition to growing our membership across a whole range of other business areas, including the public sector. And for the first time in 2015, the Office for National Statistics included our data in its official crime statistics publication.

While data and technology are our core business, we know that education and awareness are also fundamental to fraud prevention. In 2015 we stepped up our work in these areas, partnering with growing numbers of organisations, such as Get Safe Online, City of London Police, Financial Fraud Action UK, Insurance Fraud Bureau, the Metropolitan Police, Cyber Street Wise and others to raise awareness of identity fraud and the small steps we can all take to protect ourselves.

As well as presenting our Annual Report in a digital format for the first time, we have structured the report in line with our four core values – Collaboration, Innovation, Integrity and Expertise. Scroll down or click on a menu item (Left)(via the icon in the header) to explore these sections in more depth.

We enabled over 350 organisations from a range of sectors to securely share data for the prevention and detection of fraud

A message from Ken Cherrett, Chair, Cifas

Title: Chair’s Message

Featuring: Ken Cherrett, Chair, Cifas

Title: Year in Review: Collaboration

Featuring: Mike Haley, Deputy Chief Executive, Cifas

In 2015 we collaborated with a wide range of organisations and individuals to strengthen fraud defences and protect victims. Our collaborative partners included members, government, law enforcement, regulators, academia, charities and a wide range of other partners.

Our relationships with police and law enforcement agencies are particularly important to us and our members. We work with them to assist in the prevention of fraud; to support the disruption of criminal gangs; and to protect the public and the UK economy from the adverse effects of financial crime. In 2015 we continued with our secondment of a member of staff to the National Fraud Intelligence Bureau and worked with the Home Office on the Joint Money Laundering Taskforce and on the plans for the more recently launched Joint Fraud Taskforce, a taskforce that works to bring industry and government together to fight fraud.

Our relationships with police and law enforcement agencies are particularly important to us and our members. We work with them to assist in the prevention of fraud; to support the disruption of criminal gangs; and to protect the public and the UK economy from the adverse effects of financial crime. In 2015 we continued with our secondment of a member of staff to the National Fraud Intelligence Bureau and worked with the Home Office on the Joint Money Laundering Taskforce and on the plans for the more recently launched Joint Fraud Taskforce, a taskforce that works to bring industry and government together to fight fraud.

Collaboration with our members

Our membership continued to grow in 2015, adding yet more data to our databases and enabling better intelligence sharing across sectors. We welcomed 60 new members in 2015, including StepChange Debt Charity, Barbon Insurance Group our first tenant vetting company – and OFGEM joining our growing list of public sector members. Over the course of the year our total membership grew by 11%.

Collaboration with Law Enforcement and the Home Office

Our relationships with police and law enforcement agencies are particularly important to us and our members. We work with them to assist in the prevention of fraud and financial crime; to support the disruption of criminal gangs; and to protect the public and the UK economy from the adverse effects of fraud and financial crime.

Our collaboration with government

In 2015, we continued to work closely with the Home Office on the implementation of the Immigration Act 2014. The Cifas Immigration Portal (CIP) has been operating since 2014 and continues to provide a valuable service, allowing 109 banks and building societies, who are not Cifas Members, to meet their requirements under the Immigration Act 2014.

Our collaboration on campaigns

2015 saw a step change in our activity to raise awareness of fraud and scams. We see collaboration as key to successful campaigns - consumers need to hear clear consistent messages and we will have more impact if we speak with one voice.

Title: Year in Review: Innovation

Featuring: Dan Beckett, Chief Technology Officer, Cifas

At Cifas we are constantly working to improve our systems to make sure our members benefit from fast, secure and innovative technology. Fraudsters are incredibly inventive: our defences must be inventive too.

In this section, our Chief Technology Officer, Dan Beckett, describes some of the key updates we made in 2015.

Modernising the National Fraud Database

Both the Cifas National Fraud Database and Cifas Internal Fraud Database underwent extensive development in 2015 and a new version of our system was released in December. The new release is more intuitive and easier for members to navigate, file and search. Developments included a new feature to help members uncover wider networks of organised crime and investigate the links between frauds in more depth.

Using Cifas data in new and innovative ways

Cifas members typically use Cifas data at application stage. This approach has prevented significant amounts of fraud, with members reporting £200 in prevented fraud for every £1 invested in Cifas membership. In 2015, we encouraged members to use Cifas in other parts of the customer lifecycle. Broader use of fraud data in this way will help to identify even more fraud.

Title: Year in Review: Integrity

Featuring: Anne Sheedy, Director of Compliance and Best Practice

At Cifas, we operate the largest cross-sector fraud prevention databases in the UK. This means we are responsible for storing personal information and records of large numbers of people. Integrity is fundamental to what we do: we are the custodians of data and we have a responsibility to handle data securely and safely, to open ourselves to scrutiny, and to act in the public interest. We are working to increase our profile and in 2015 we saw significant increases in enquiries, website visits, media coverage and subject access requests. Ensuring that increasing numbers of people are aware of Cifas and its work will help us to support those who seek our advice in preventing fraud or want to find out more about the data we hold.

In 2015, the Information Commissioner’s Office published the results of an audit of Specified Anti-Fraud Organisations in the UK, including a successful audit of Cifas. We also reviewed the way we monitor our members’ use of data – our Member Compliance programme. This review resulted in plans to expand our current compliance operation to create a bigger “Compliance and Best Practice” team to work with our members. This new team will also focus on sharing learning more effectively across the membership so that all of the businesses we work with are supported to handle fraud data effectively and efficiently – ultimately preventing more fraud against their own business and customers.

In the rest of this section we look at how Cifas is governed, how we manage member compliance and how we dealt with enquiries or complaints from the public in 2015.

Changing the way we are governed

In 2015 the Cifas Board commissioned an independent review of the way Cifas is governed. In the 25 years since Cifas was founded, we have grown from a small credit industry group into the UK’s leading fraud prevention organisation, working with more 350 businesses spanning the public, private and charity sectors.

How we assisted the public in 2015

The number of enquiries to Cifas and requests for information grew significantly in 2015. In total, we received 2,790 enquiries from the public and 1,242 Subject Access Requests. This compares to 1,823 and 1,046 respectively in 2014.

Cifas Member Compliance Reviews

Our compliance reviews are integral to maintaining high standards of data handling and ensuring that organisations are not only benefiting from accessing fraud information from others, they are also contributing information on their own fraud losses.

Title: Year in Review: Expertise

Featuring: Sandra Peaston, Assistant Director, Insight, Cifas

At Cifas, we are experts in sharing confirmed fraud data and intelligence. This section covers the core services we offer with this data and the trends we saw in 2015, including the research reports that we published.

We also explore the services we offer directly to the public – our Protective Registration and Protecting the Vulnerable services.

We believe our expertise comes not just from data and systems – but from our people. In line with this, we have included a section on our people under this value.

Identity fraud dominates: 2015 fraud trends from our National Fraud Database

In 2015, our National Fraud Database enabled 261 organisations from a wide range of sectors to share data in the areas of identity crime and first party frauds, committed both by individuals and by companies. In addition, Cifas enabled our members to access a range of additional datasets (law enforcement alerts, deaths data from the General Register Office, fraudulent Royal Mail redirects, and Home Office immigration data) in order to determine risk and aid investigations.

Insider threats: 2015 fraud trends from our Internal Fraud Database

Our Internal Fraud Database helps organisations to ensure that they do not employ someone with a known history of committing fraud as well as acting as a strong deterrent for existing staff who may be tempted or coerced into committing fraud. The types of fraud we see are changing: while application fraud remains a major issue and theft of cash still happens, the theft of data is one of the biggest threats.

Research and training

At Cifas we carry out research projects every year to inform our members, our partners and the public about issues, trends and subjects to help inform fraud prevention strategies.

Protecting individuals from fraud

Cifas Protective Registration and Protecting the Vulnerable

With identity theft continuing to rise, demand for our Protective Registration Service grew significantly in 2015. The service works by registering a protective marker against the identity details of individuals who are at particular risk of identity fraud – usually because their details have been stolen, lost or hacked.

Our people

Cifas is lucky to have a committed and passionate workforce, with a high number of staff staying with the organisation for many years. We are a growing organisation and we want to attract talented, committed fraud prevention professionals.

Throughout 2015, there has been a continued focus on increasing the membership, while improving services and benefits to members. We remain committed to keeping both our cost base and subscriptions levels as low as possible, with our Board’s intent being that additional income generated in 2015 be used, at least in part, to minimise any future subscription increases.

Cifas Vision to 2020

Cifas has a clear Vision to 2020: to be a more dynamic, innovative, collaborative and visible organisation.

Size: 125Kb

Directors’ report and financial statements for the year ended 31 December 2015

The directors present their report and the financial statements for the year ended 31 December 2015.

Size: 290Kb

Title: Introduction and Overview, featuring Simon Dukes, CEO (138KB)

Title: An overview of the year (145KB)

Title: Introduction and Overview, Ken Cherrett, Chair (129KB)

Title: Year in Review: Collaboration, featuring Mike Haley (137KB)

Title: Collaboration with our members, the Business Engagement Team, featuring Gaby Devereux, Assistant Director, Engagement, Cifas and Lee D’Arcy, Director of Engagement, Cifas (140KB)

Title: Collaboration with our members (99KB)

Title: Collaboration with our members: Our Members (137KB)

Title: Collaboration with our members, featuring Commander Christopher Greany, National Coordinator for Economic Crime, The City of London Police (138KB)

Title: How Cifas collaborates with Law Enforcement (191KB)

Title: Year in Review: Innovation, featuring Dan Beckett, Chief Technology Officer (138KB)

Title: Year in Review: Integrity, featuring Anne Sheedy (135KB)

Title: Changing the way we are governed (198KB)

Title: Year in Review: Expertise, Sandra Peaston, Assistant Director, Insight, Cifas (137KB)

Title: Identity fraud dominates: 2015 fraud trends from our National Fraud Database (163KB)

Title: Our chief executive talking about internal fraud risks in 2015 (145KB)

Title: Cross-Sector Fraud Data Could Unlock Millions in Additional Insurance Savings (3MB)

Title: Employee Fraudscape (2015 edition) (1.63MB)

Title: Fraudscape: UK fraud trends (194KB)

Title: Research & Training: Training courses and delegates (232KB)

Title: Protecting individuals from fraud (136KB)

At present, you can contact Cifas online through our website, or by writing to us.

Data security is very important to Cifas, so we need to verify your identity before we give out or discuss personal information. This is why we do not currently take enquiries over the phone. But we always aim to respond to your query within 24 hours.

Before you get in touch we recommend that you check our Frequently Asked Questions or Consumer Complaints, which answer many people’s questions immediately. Enquirers often get in touch with Cifas with questions that need to be directed to their bank or other organisation. Checking our FAQs can save you time.

Email a general enquiry

enquiries@cifas.org.uk

Email us feedback on this year’s annual report

feedback@cifas.org.uk

Write to us

The Compliance Officer, Cifas, 6th floor, Lynton House, 7-12 Tavistock Square, London WC1H 9LT

We always aim to respond to your query within 24 hours.